Growth for Port of Antwerp-Bruges in first half of 2024

Positive trend in container throughput expands to other product groups

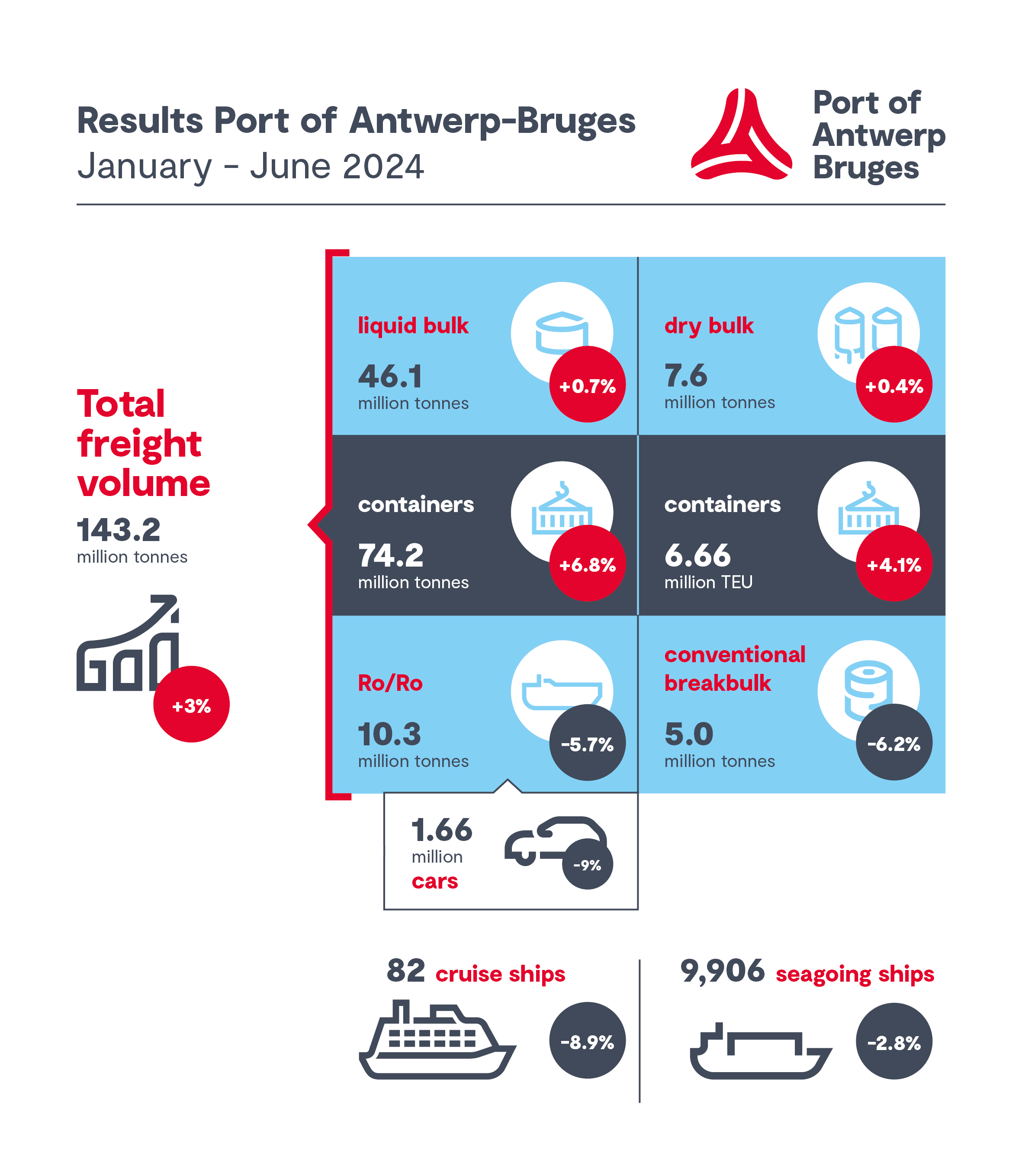

The total throughput of Port of Antwerp-Bruges was 143.2 million tonnes in the first six months of this year, an increase of 3% compared to the same period last year. This upward trend, which started in the first quarter driven by increased demand for container transport, is now extending to other product categories as well. This is despite ongoing geopolitical tensions and an uncertain macro-economic climate. Port of Antwerp-Bruges continues to be a pioneer, investing in a future-proof port.

In the first quarter, container throughput recovered following a global slowdown due to economic uncertainty and inflation. This growth continued in the second quarter. In the meantime, sailing around the Cape of Good Hope has become the 'new normal'. This ensured a rise in total container throughput of 6.8% in tonnes and 4.1% in TEUs (6,665,000 TEUs), compared to the first half of 2023.

Throughput volumes of conventional breakbulk also showed an upward trend. This started in the first quarter, following a weak final quarter of 2023. Despite throughput in the first half of the year being 6.2% lower than the same period last year - due to a 12.6% decrease in imports and a 4.5% increase in exports, throughput improved in the second quarter compared to the first quarter.

In the past six months, throughput of iron and steel has remained more or less stable (+0.6%), with a growth in exports (+7.4%) and a drop in imports (-3.7%). This contrasts with the first quarter, which experienced a growth in imports and a decline in exports. Although most other goods continued to show a decline compared to the same period last year, the throughput of these products increased compared to the first quarter.

Roll-on/roll-off traffic dropped in the first half of 2024 by 5.7% – a minor improvement compared to the end of the last quarter. The congestion at the RoRo terminals persists due to the altered business model of the car manufacturers stockpiling at the ports, decreased demand and delayed exports caused by sailing around the Cape of Good Hope. This resulted in a decrease in throughput for all transport materials by 13.2%. The lower throughput of second-hand cars in particular (-45.8%) contributed to this, followed by high & heavy (-22.7%), trucks (-17.6%) and new cars (-9%). Throughput of unaccompanied cargo (excluding containers) carried on RoRo vessels, on the other hand, rose by 2.4%. The decline in throughput to and from the United Kingdom (-4.6%) was more than compensated by an increase in throughput to and from Spain and Portugal (+35%), Scandinavia (+18%) and Ireland (+1.4%).

The dry bulk segment remains stable with a slight increase of 0.4% – a significant improvement compared to the 12.2% decline in the first quarter. Imports decreased by 6%, while exports rose by 10.9%. A sharp rise (+34.8%) was observed in the throughput of fertilisers. This is the largest product category within dry bulk and is now recovering after a sharp decline in 2023. The throughput of non-ferro ores (+26.9%) and other construction materials (other than sand and gravel) (+13.6%) grew. The throughput of coal (-40%), grains (-9.5%), sand & gravel (-8.3%) and scrap (-5.9%) dropped.

The throughput of liquid bulk, which experienced a slight decline of 0.7% in the first quarter, grew by 0.7% by the end of the second quarter. A decrease in imports by 2.4% was compensated by a rise in exports of 5.4%. There was an increase in the throughput of gasoline (+18%) and fuel oil (+10.2%). Despite the ongoing pressure on the competitiveness of the European chemical industry due to the high costs of energy, raw materials and labour, recovering demand led to an increase in throughput of naphtha (8.2%) and chemicals (+6.7%). Diesel throughput dropped by19.3%, while LNG and other energy gases also saw declines of 6.4% and 3.6% respectively. Liquid fuels in total experienced a slight decline (-1.1%).

During the first half of 2024, 9,906 ocean-going vessels called at the port, marking a decrease of 2.8%. The gross tonnage of these vessels fell by 4.2%.

During the first half of 2024, Zeebrugge received 270,600 cruise passengers (+8.9%) on 82 cruise ships. This represents a decrease of eight cruise ships compared to last year (-8,9%), indicating an increase in cruise ship occupancy levels.

Future-proof and climate-neutral

The figures confirm the resilience of the port, which is continuing to pioneer and invest in a future-proof port in challenging times.

May saw a global first with the launch of the world's first tug-boat running on methanol, the Methatug. This, just like the Hydrotug, the first tug-boat running on hydrogen, is part of a greening programme for our own fleet. As such, Port of Antwerp-Bruges once again took some important steps in the transition towards a climate-neutral port by 2050. The first shore power connection for ocean-going vessels in Belgium confirmed the port's pioneering role in the energy transition in the maritime sector. The installation of one of Europe's largest public charging stations for electric trucks makes the Antwerp port area an indispensable link in electric truck transport.

Sustainable growth remains a priority for guaranteeing a future-proof port. In the first quarter, a container ship with a draught of 16 metres entered the Deurganck Dock for the first time under the normal admission policy. Four container ships with that draught entered in the second quarter. Admission for this has since been extended to other container terminals.

Besides the establishment of the initial draft project decision for the complex project New Zeebrugge Lock, the completion of the initial phase of the development of the Southern Channel Basin and the accompanying expansion of the ICO RoRo terminal by 600 metres of extra quayside was a major milestone for the Zeebrugge port platform.

Jacques Vandermeiren, CEO at Port of Antwerp-Bruges: ”The past half year has certainly not been without challenges. But despite the ongoing geopolitical tensions, a still fragile economic climate and farmers' protests, we are continuing with positive figures once more, showing even stronger growth in the first quarter. Alongside container throughput, other product groups are also experiencing a positive trend. Moreover, despite these challenges, we remain committed to advancing our pioneering role in the energy transition, including initiatives such as shore power projects and truck charging infrastructure. This indicates that we are progressing towards making 2024 a year of significant achievements across all areas, driven by our ongoing resilience and the collective efforts of the entire port community.”

Annick De Ridder, Port Alderman for the City of Antwerp and Chair of the Board of Directors for Port of Antwerp-Bruges: "Our growth stands as compelling evidence of our resilience as a world port and our dedication as ambitious pioneers. Furthermore, our market share in the Hamburg – Le Havre Range is continuing to grow. With the launch of the Methatug, we proved once again that we will continue to pioneer and invest even during challenging times. Now that we can accommodate ships with a draught of 16 metres, Antwerp is very well- positioned to be the first port of call for the largest container ships. This is how we and our companies are fully focused on sustainable growth and are reinforcing our position as the economic engine of Flanders.”

Dirk De fauw, Mayor of the City of Bruges and Deputy Chair of Port of Antwerp-Bruges: “These positive figures show once again how strong we are with two complementary port platforms. But in order to maintain our role as a world port and a key gateway to and from Europe, capacity and sustainable growth are needed. Establishing the initial draft project decision for the New Lock at Zeebrugge was a major milestone, as was the further development of the Southern Channel Basin at Zeebrugge with the expansion of ICO's RoRo terminal.”